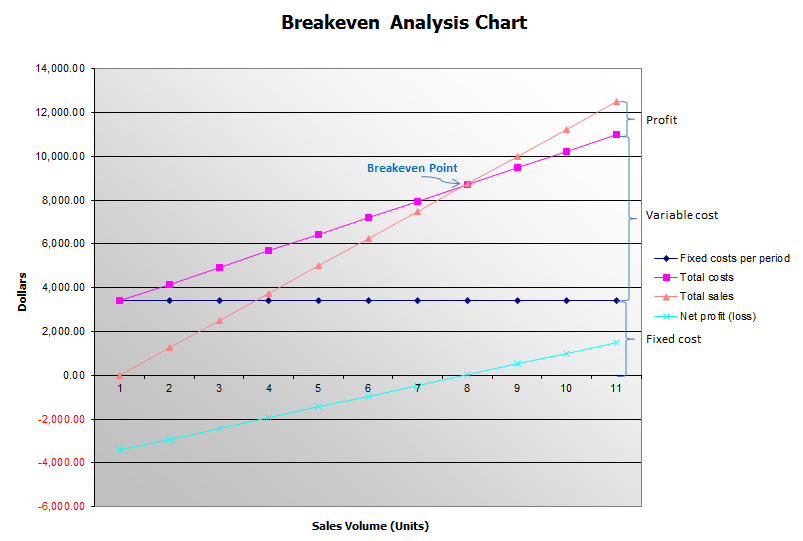

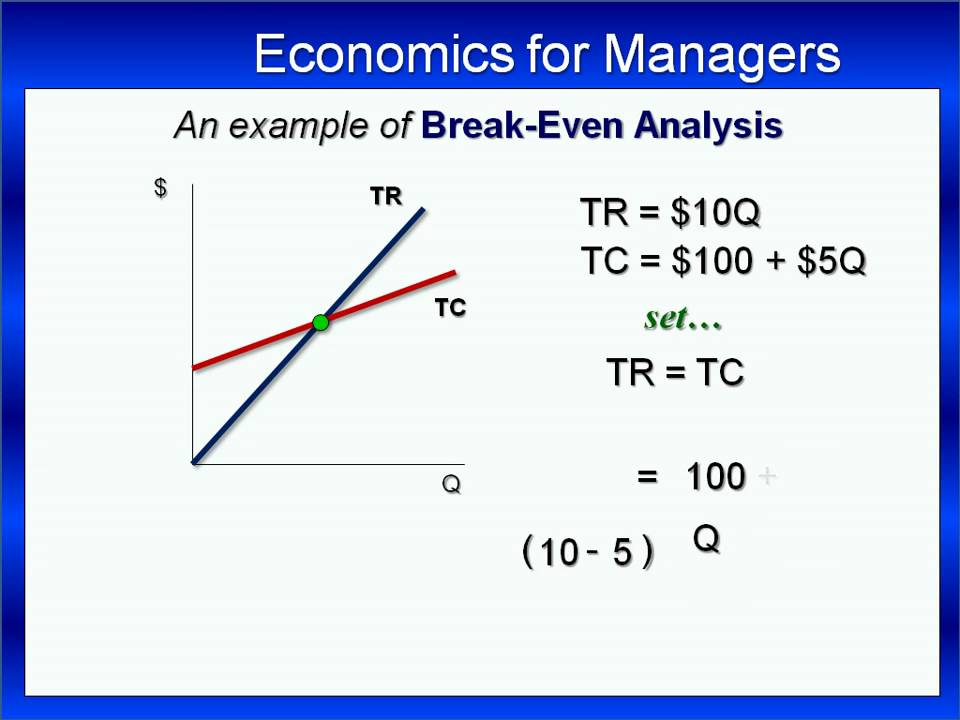

An analysis to determine the point at which revenue received equals the costs associated with receiving the revenue. Break-even analysis calculates what is known as a margin of safety, the amount that revenues exceed the break-even point.

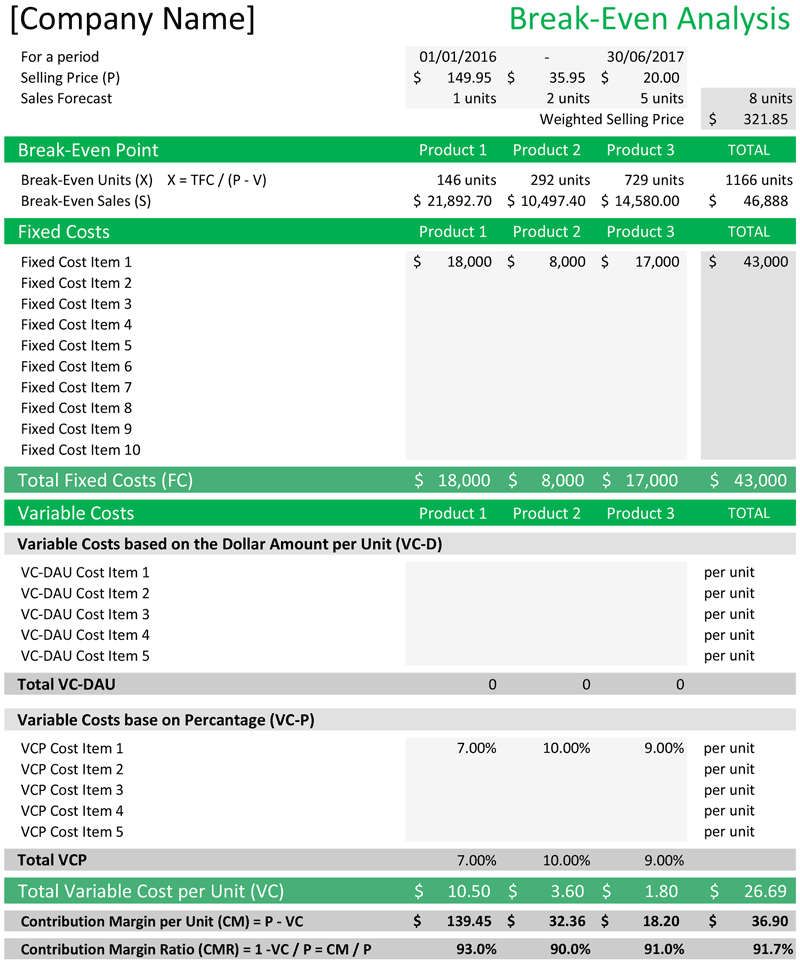

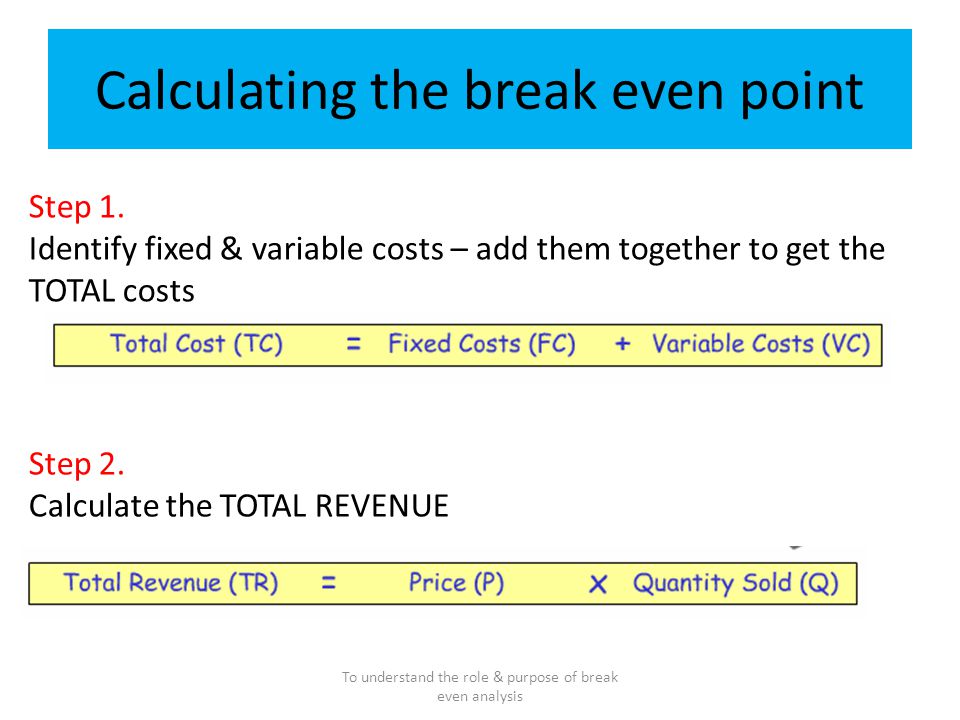

Calculating the breakeven point is a key financial analysis tool used by business owners. Once you know the fixed and variable costs for the product your business produces or a good approximation of them, you can use that information to calculate your company’s breakeven point.

In my previous post, I showed how to create equity return factors using principal component analysis.In this post, I’m going to compare the three PCA factors I created to the three Fama-French factors.

ADVERTISEMENTS: Break-even analysis is of vital importance in determining the practical application of cost functions. It is a function of …

Lenders use the break-even ratio as one of their analysis methods when considering providing financing. Here’s how to calculate it.

Break even point is the business volume that balances total costs with total gains. At break even volume, cash inflows equal cash outflows, exactly, and …

Find the break even point easily with any of our break even point calculators. They are free to download.

Break-even (or break even) is the point of balance making neither a profit nor a loss. The term originates in finance, but the concept has been applied widely since. Often abbreviated as B/E in finance.

We support America’s small businesses. The SBA connects entrepreneurs with lenders and funding to help them plan, start and grow their business.

business – Determining Your Break-Even Point – Entrepreneur.com